QuickBooks for Nonprofits is an essential tool designed to help nonprofit organizations manage their finances with ease and accuracy. Unlike for-profit businesses, nonprofits have unique accounting needs, such as managing donations, tracking restricted funds, and maintaining transparency with stakeholders and regulators.

QuickBooks provides the necessary features to address these needs, offering nonprofits a user-friendly, comprehensive accounting solution that streamlines financial management processes.

Why QuickBooks for Nonprofits:

- Budgeting & Forecasting: Helps create, manage, and track budgets specific to nonprofit needs. Nonprofits can access detailed financial reports in real-time to make informed decisions.

- Reporting: Provides customizable financial reports that track performance over time. Users can easily generate reports for specific periods, export data for analysis, and share with stakeholders.

- Donor Management: Consolidates donor information, tracks donation history, and streamlines donation processes through automation.

- Staff & Volunteer Management: Tracks employee and volunteer hours, manages tasks, and supports team collaboration on projects in real-time.

- Automated Payments: Offers automated invoice reminders, payment schedules, and direct deposit features, reducing manual errors and speeding up transactions.

Why QuickBooks is Essential for Nonprofits

Nonprofit organizations face unique accounting challenges such as managing donations, grants, restricted funds, and ensuring compliance with regulatory standards. QuickBooks for Nonprofits addresses these challenges with specialized features like fund accounting and donor management, enabling streamlined financial operations and greater accuracy.

Setting Up QuickBooks for Nonprofits

Setting up QuickBooks for your nonprofit is the first step in ensuring the platform is tailored to meet your organization’s unique financial needs. Proper setup is crucial for maintaining accurate financial records, tracking income and expenses, and reporting to stakeholders.

QuickBooks Versions for Nonprofits

QuickBooks offers several versions, including QuickBooks Desktop, QuickBooks Online, and QuickBooks for Nonprofits. Here’s how to choose the best option:

- QuickBooks Desktop: Best suited for organizations that prefer a one-time purchase and local installation. It offers powerful features but lacks the flexibility of cloud-based access.

- QuickBooks Online: Ideal for nonprofits that need access to their financial data from anywhere. It’s cloud-based, automatically updated, and offers more integration options with other online tools.

- QuickBooks for Nonprofits: This version is tailored specifically for nonprofits, including features like pre-built reports, donation tracking, and fund accounting.

Each version has its strengths, and choosing the right one depends on your organization’s size, complexity, and specific needs.

Initial Setup

The initial setup of QuickBooks involves creating a nonprofit company file that reflects your organization’s financial structure. This process includes:

- Setting Up Your Chart of Accounts: The Chart of Accounts is the backbone of your financial system, organizing your income, expenses, assets, and liabilities. For nonprofits, it’s essential to set up accounts that track different types of donations, grants, and expenses.

- Defining Revenue Sources: Nonprofits often have multiple revenue streams, including grants, donations, and fundraising events. Ensure that each source is tracked separately to maintain financial clarity.

Setting Up Nonprofit-Specific Accounts

Nonprofits must carefully track specific types of transactions, including donations, restricted grants, and in-kind contributions. Properly setting up accounts to track these activities helps ensure accurate financial reporting and compliance.

This setup will also streamline tax filings by ensuring your nonprofit adheres to IRS regulations for tax-exempt organizations.

Key Features of QuickBooks for Nonprofits

QuickBooks provides nonprofits with a range of tools designed to manage everything from budgeting to donor relations. Below are some of the standout features of QuickBooks for Nonprofits:

1. Budgeting & Forecasting

Effective budgeting is crucial for nonprofits that rely on multiple revenue sources and need to manage restricted funds. With QuickBooks, nonprofits can:

- Create Detailed Budgets: Organizations can set up and manage budgets for specific programs, projects, or departments, ensuring that each area is funded appropriately.

- Track Budget vs. Actuals: QuickBooks makes it easy to monitor budgeted expenses compared to actual spending, allowing nonprofits to make adjustments in real-time.

- Forecast Financial Trends: Forecasting tools allow organizations to predict future financial needs based on past performance, helping nonprofits plan for future growth or potential funding gaps.

2. Comprehensive Reporting

Nonprofits need to generate various reports for board members, funders, and regulatory agencies. QuickBooks for Nonprofits makes this process simple with:

- Pre-Built Reports: These include common nonprofit-specific reports like the Statement of Financial Position (Balance Sheet) and the Statement of Activities (Income Statement).

- Customizable Reports: Organizations can create reports that track specific funding sources, expenses, and financial performance metrics.

- Automated Reporting: QuickBooks can automatically generate and email reports to stakeholders, ensuring transparency and accountability without the need for manual intervention.

3. Donor Management

Managing donor information is vital for nonprofits. QuickBooks consolidates donor data in one place, making it easy to track donations and donor engagement. Features include:

- Donation Tracking: Track one-time or recurring donations and attribute them to specific donors.

- Automated Receipts: QuickBooks generates and sends donation receipts automatically, reducing manual work and ensuring donors receive timely acknowledgments.

- Donor Reporting: Nonprofits can generate reports showing donor history and trends, allowing them to segment donor lists and tailor fundraising campaigns.

4. Staff & Volunteer Management

QuickBooks simplifies managing your nonprofit’s staff and volunteers by allowing you to:

- Track Volunteer Hours: Keep a record of volunteer contributions, which can be essential for reporting or grant applications.

- Manage Employee Information: Store employee contact details, roles, and time off, ensuring that HR data is accessible and organized.

- Task Management: QuickBooks enables collaboration by allowing team members to manage and assign tasks in real-time, improving efficiency.

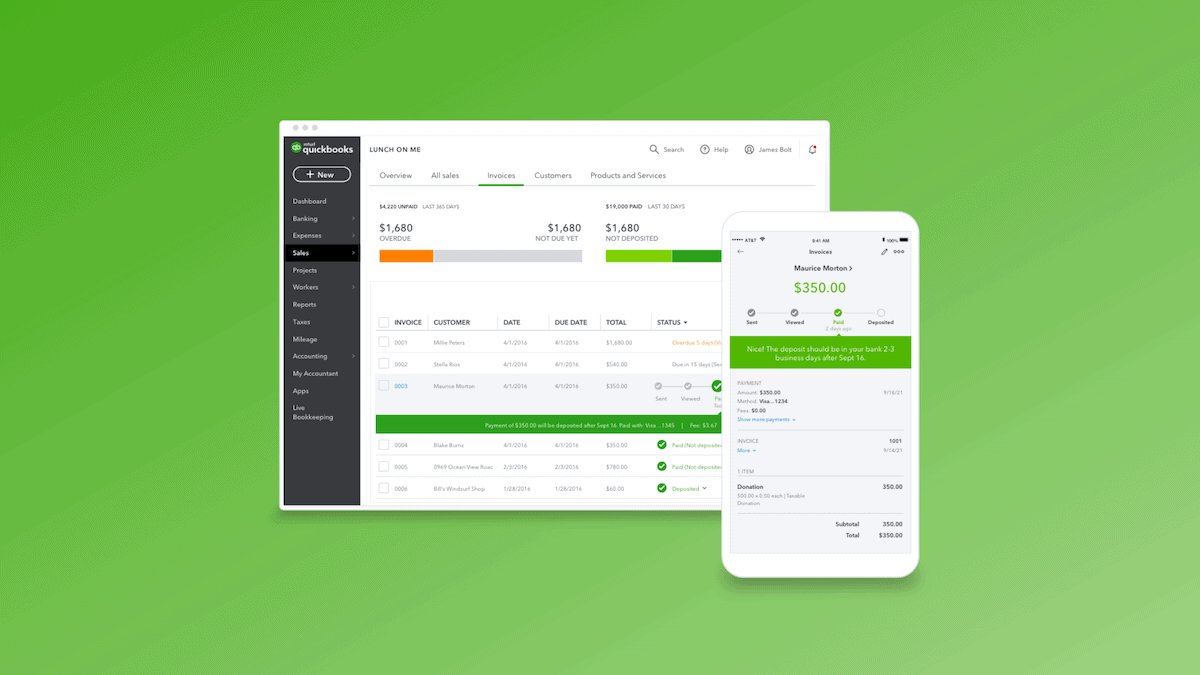

5. Automated Payments

QuickBooks automates many aspects of the payment process, reducing manual errors and improving accuracy. Key features include:

- Automated Invoicing: Schedule invoices to be sent at regular intervals, helping to maintain consistent cash flow.

- Payment Reminders: QuickBooks automatically sends reminders for unpaid invoices, ensuring timely payments.

- Direct Deposits: Automate direct deposit payments for vendors or employees, speeding up the payment process and reducing delays.

Integrating QuickBooks with Nonprofit Tools

Integrating QuickBooks with other platforms can streamline your nonprofit’s operations. These integrations include:

Integration with Donor Management Systems

Many nonprofits use CRM (customer relationship management) software to manage donor data. QuickBooks integrates with popular CRM systems, allowing nonprofits to:

- Sync Donor Information: Keep donor data up-to-date between systems.

- Track Contributions: Automatically track donations made through different channels and sync them with your accounting system.

Integration with Fundraising Platforms

Nonprofits often use online fundraising platforms to collect donations. Integrating QuickBooks with these platforms ensures:

- Seamless Data Transfer: Donations made through your fundraising platform are automatically recorded in QuickBooks, saving time and reducing errors.

- Detailed Donor Reports: Easily generate comprehensive reports that track online donations and donor trends.

Reporting and Compliance

- Nonprofit-Specific Reports: QuickBooks offers critical reports like the Statement of Financial Position (Balance Sheet), Statement of Activities (Income Statement), and Statement of Functional Expenses, helping meet regulatory requirements.

- Audit Preparation: QuickBooks organizes financial data for nonprofits, ensuring accurate record-keeping and easy preparation for audits.

- Compliance and Tax Reporting: Helps nonprofits prepare for annual Form 990 filings by tracking essential financial data throughout the year.

Common Challenges and Solutions

- Managing Restricted Funds: QuickBooks offers fund-tracking features to help nonprofits handle restricted funds and manage multiple funding sources.

- Troubleshooting: QuickBooks provides support channels and expert advice to troubleshoot errors and discrepancies in accounts.

Nonprofit Resources

The Charity Charge resource hub is dedicated to providing tips, tools, and information to help your nonprofit create and grow a modern organization. Learn more

Get our checklist of the best free nonprofit tools of 2024 sent directly to your inbox

Pricing: QuickBooks for Nonprofits

QuickBooks offers tailored plans to meet the diverse needs of nonprofit organizations, allowing them to choose the best option based on their size, financial management complexity, and required features.

Below is a summary of the available plans:

Plus Plan

The Plus plan offers comprehensive features that enable nonprofits to manage projects, billing, and contractors, making it a popular choice for growing organizations.

This plan includes bookkeeping automation and various tools to handle financial tracking and reporting.

Price: $49.50/month (Save 50% for the first 3 months, then $99/month)

Key Features:

- Free guided setup

- Income and expense tracking

- Banking with 5.00% APY

- Bookkeeping automation

- Invoicing and payments

- Tax deductions and comprehensive reports

- Receipt capture and mileage tracking

- Cash flow management and sales tax tracking

- Multi-currency support

- Bill management and inventory tracking

- Project profitability analysis

- Financial planning tools

- Includes up to 5 users

This plan is ideal for small to medium-sized nonprofits that need efficient financial tracking and project management features.

Advanced Plan

The Advanced plan is designed for larger nonprofits or those with complex financial operations. It includes all the features of the Plus plan but with more advanced tools and capabilities, making it suitable for growing organizations with more intricate needs.

Price: $117.50/month (Save 50% for the first 3 months, then $235/month)

Key Features:

- All features from the Plus plan, plus:

- Access to expert tax help with QuickBooks Live Tax

- Auto-tracking of fixed assets

- Data sync with Excel for financial planning

- Employee expense management

- Batch invoicing and expenses

- Custom access controls for user permissions

- Workflow automation to streamline processes

- Data restoration features

- 24/7 support and training access

- Revenue recognition tools

- Includes up to 25 users

This plan is suited for large nonprofits or those needing robust financial management tools with more users and advanced features like automation and data synchronization.

Quickbooks Enterprise for Nonprofits

For large-scale nonprofits with extensive accounting needs, the Enterprise plan offers the most advanced features. It is designed to help organizations with high volumes of transactions, reporting, and user management. This plan also includes a dedicated account team to help nonprofits scale.

Price: Starting at $180/month (Desktop solution with hosting)

Key Features:

- Built-in templates and financial statements

- Online data backup and restore

- Advanced reporting capabilities

- Dedicated account team for personalized support

- Online access to training resources

- Ability to add up to 40 users

This plan is ideal for enterprise-level nonprofits that require extensive reporting, multiple users, and a dedicated support team.

Choosing the Right Plan for Your Nonprofit

• Small to Medium Nonprofits: The Plus Plan is an excellent choice if you are a small or mid-sized nonprofit that needs essential accounting features, project tracking, and donor management tools.

• Growing Nonprofits: The Advanced Plan is better suited for organizations that are scaling and need more sophisticated tools like workflow automation, batch invoicing, and custom user access controls.

• Large Nonprofits: For enterprise-level organizations, the Enterprise Plan offers the most comprehensive toolset, with up to 40 users and advanced reporting features to support larger financial operations.

Conclusion

QuickBooks for Nonprofits is a comprehensive solution that simplifies accounting and financial management for nonprofit organizations. With tools for automated payments, donor management, budgeting, and reporting, nonprofits can focus on their mission while staying organized and compliant with financial regulations.

Whether managing large grants or small donations, QuickBooks empowers nonprofits to manage their financial operations efficiently.

For nonprofits looking to optimize their financial management, QuickBooks for Nonprofits offers the right mix of features to streamline processes, enhance fundraising efforts, and provide valuable financial insights.

This updated guide integrates the latest information from the provided source and ensures clarity in presenting QuickBooks’ functionality for nonprofit organizations.