The premise of managing your own money is a daunting one. But in this digital age, technology platforms are making it increasingly easier to track, save and spend your money in a savvy way. These three apps are must-haves for improving your financial health.

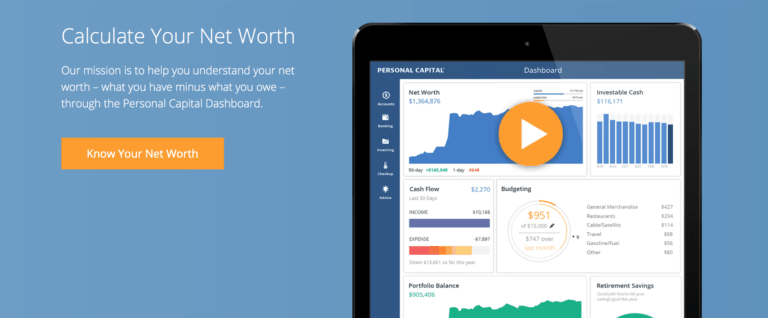

Personal Capital

Think about all the accounts that comprise your financial life: checking, savings, investments, retirement, mortgage, loans, credit cards, etc. That’s a lot to keep track of! Personal Capital is a free app that aggregates all these accounts onto one dashboard. The app calculates your net worth, tracks your income and spending, helps you set a budget, monitors your investment accounts, and advises you as you plan for retirement. If you only download one money app this month, this is the one.

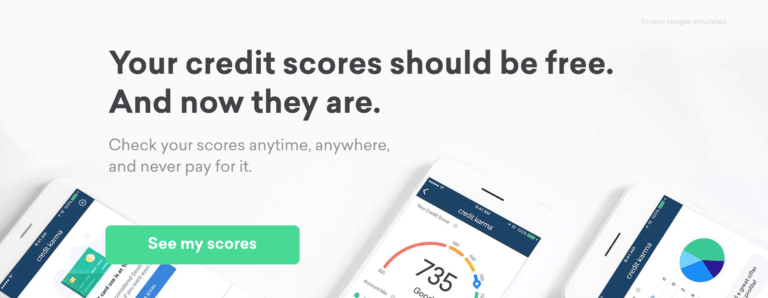

Credit Karma

Your credit score is an important number to know. It determines whether you’re approved for a credit card, your ability to rent an apartment, the interest rate on your mortgage, insurance premiums, security deposits, and even job applications. Credit Karma is an app that makes it easy to access your credit score and credit reports for free. It breaks down the five factors that contribute to your credit score and tells you exactly where you stand on each. Now that your score is free and accessible, there’s no excuse not to monitor it.

Ebates

As our society evolves away from brick-and-mortar retail and toward online shopping, more and more ways to save have emerged. That includes shopping portals like Ebates! Ebates allows you to earn cash back for every dollar you spend at thousands of retailers. All you have to do is sign up for an Ebates account (and automatically earn $10), click on your retailer, and shop like normal. Ebates sends you a check every three months for the cash you’ve racked up.

Related Post: 3 WAYS TO SAVE UP FOR A SUMMER VACATION